Industrial Gases Market Trends, Growth & Forecast 2025-2033

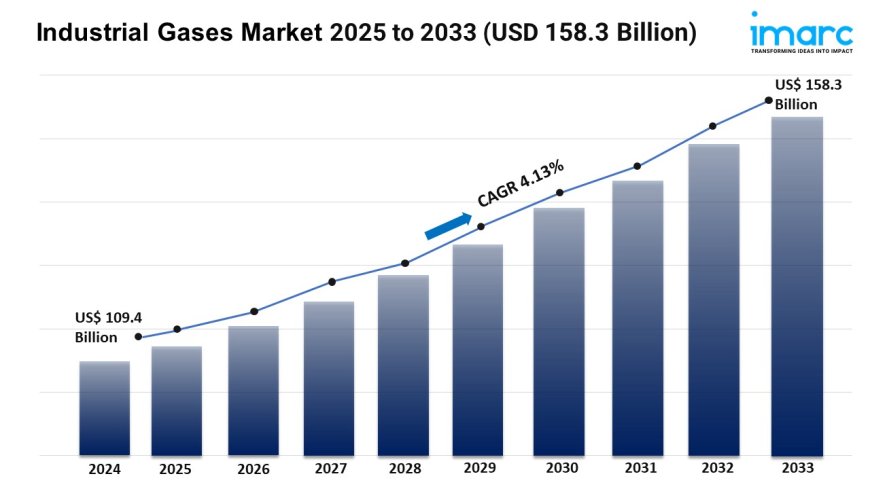

The global industrial gases market size reached USD 109.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 158.3 Billion by 2033, exhibiting a growth rate (CAGR) of 4.13% from 2025-2033.

Market Overview:

The industrial gases market is experiencing rapid growth, driven by surging demand from manufacturing and processing sectors, rising healthcare applications, and shift toward cleaner energy solutions. According to IMARC Groups latest research publication, Industrial Gases Market Size, Share, Trends and Forecast by Type, Application, Supply Mode, and Region, 2025-2033, the global industrial gases market size reached USD 109.4 Billionin 2024. Looking forward, IMARC Group expects the market to reachUSD 158.3 Billionby 2033, exhibiting a growth rate(CAGR) of 4.13%from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/industrial-gases-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Industrial Gases Market

- Surging Demand from Manufacturing and Processing Sectors

The global industrial gases industry is booming due to massive demand from manufacturing and processing sectors like metal fabrication, chemicals, and food processing. Factories rely on gases like oxygen for welding and nitrogen for preserving food quality. For instance, the International Monetary Fund notes a 6% annual growth in industrial production in emerging markets, driving up the need for gases in cutting, welding, and chemical synthesis. Companies like Air Liquide and Linde are expanding production to meet this demand, with Air Liquide recently investing in new oxygen plants in Asia-Pacific to support steel manufacturing. Government schemes, like Indias Make in India initiative, are pushing industrial growth, further increasing gas consumption. This surge is fueled by rapid urbanization and infrastructure projects in developing regions, making manufacturing a key driver for the industry.

- Rising Healthcare Applications

Healthcare is a major growth engine for industrial gases, especially oxygen, which is critical for patient care and respiratory treatments. The demand spiked during the COVID-19 pandemic, and its still strong as hospitals expand in regions like Asia-Pacific and Latin America. For example, Linde reported a 15% increase in medical oxygen sales in key markets last year. Governments are also stepping inChinas healthcare reforms include funding for hospital infrastructure, boosting gas needs. Nitrous oxide and carbon dioxide are increasingly used in medical procedures and diagnostics, too. Small and medium-sized enterprises are innovating with portable oxygen solutions, making healthcare more accessible. This trend is particularly strong in emerging economies, where investments in healthcare infrastructure are creating new opportunities for gas suppliers to meet growing medical demands.

- Shift Toward Cleaner Energy Solutions

The push for cleaner energy is driving demand for industrial gases, especially in renewable energy and green fuel technologies. Hydrogen is gaining traction as a clean energy source for industries like steel and aviation. For example, Air Products recently announced a multi-billion-dollar project to build a green hydrogen production facility in the Middle East. Government schemes, like the EUs Green Deal, are funneling funds into hydrogen infrastructure, encouraging companies to scale up. Natural gas, supported by gases like methane, remains a bridge fuel, with the U.S. expanding LNG export facilities to meet global energy needs. Posts on X highlight big players like Reliance and Adani investing heavily in green hydrogen, reflecting the industrys shift toward sustainable energy solutions that rely on industrial gases.

Key Trends in theIndustrial GasesMarket

- Adoption of Advanced Gas Blending Technologies

Gas blending platforms are transforming the industrial gases market by delivering precise gas mixtures for specialized applications. Companies like Praxair Technology and Air Liquide are investing in smart blending systems that use sensors and automation to ensure accuracy in industries like electronics and pharmaceuticals. For instance, Air Liquides recent facility upgrade in Europe introduced AI-driven blending for high-purity gases, cutting production errors by 20%. These platforms are critical for creating tailored gas solutions, like nitrogen-oxygen mixes for food packaging or hydrogen blends for fuel cells. The trend is gaining traction in Asia-Pacific, where manufacturing is booming. As industries demand more customized gas compositions, blending technologies are becoming a game-changer, improving efficiency and meeting strict regulatory standards.

- Growth in Food-Grade Gas Applications

The food-grade gases market is exploding, driven by soaring demand for packaged and frozen foods. Nitrogen and carbon dioxide are used to extend shelf life and maintain product freshness, with companies like Gulf Cryo expanding their food-grade gas portfolios. A recent report noted that global packaged food sales hit $2 trillion last year, fueling gas demand. Innovations like modified atmosphere packaging (MAP), which uses gas mixtures to preserve food, are becoming standard. For example, Lindes MAP solutions are now used by major U.S. food brands to keep products fresh during long-distance shipping. Government regulations pushing food safety, like the EUs stringent standards, are also driving adoption. This trend is reshaping the food industry, with gases playing a starring role in quality and sustainability.

- Expansion of Smart Gas Cylinders and Monitoring

Smart gas cylinders equipped with IoT sensors are revolutionizing the industry by improving safety and efficiency. These cylinders track gas levels, detect leaks, and monitor pressure in real time, reducing waste and risks. For example, Air Products rolled out a smart cylinder system in 2024, cutting downtime for clients by 15% through predictive maintenance. The Asia-Pacific region, with its 46.4% share of the global gas cylinder market, is leading adoption due to its manufacturing surge. Government initiatives, like the U.S. Department of Energys safety programs, are encouraging smart technology use. This trend is particularly impactful in industries like chemicals and healthcare, where precise gas management is critical, making smart cylinders a must-have for modern operations.

We explore the factors driving the growth of the market, including technological advancements, consumer behaviors, and regulatory changes, along with emerging industrial gases market trends.

Leading Companies Operating in the Industrial Gases Industry:

- Air Liquide S.A.

- Linde Group

- Air Products and Chemicals, Inc.

- Airgas, Inc.

Industrial Gases Market Report Segmentation:

By Type:

- Nitrogen

- Oxygen

- Carbon Dioxide

- Argon

- Hydrogen

- Others

Nitrogen dominates the market due to its versatile applications in preservation and purging, safety advantages, and ongoing production technology advancements enhancing purity levels.

By Application:

- Manufacturing

- Metallurgy

- Energy

- Chemicals

- Healthcare

- Others

Manufacturing leads the segment as industrial gases are essential for welding, cutting, and process optimization across multiple production industries.

By Supply Mode:

- Packaged

- Bulk

- On-site

Packaged gases hold significant share owing to their portability, convenience, and wide usage across diverse industrial and healthcare applications.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific accounts for the largest share, driven by rapid industrialization, manufacturing growth, and expanding healthcare infrastructure across emerging economies.

Research Methodology:

The report employs acomprehensive research methodology, combiningprimary and secondary data sourcesto validate findings. It includesmarket assessments, surveys, expert opinions, and data triangulation techniquesto ensureaccuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the worlds most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

![Top 9 Real Estate Mobile App Developers in Riyadh, Saudi Arabia [2025 Edition]](https://www.biphoo.uk/uploads/images/202507/image_430x256_6879d0d524335.jpg)