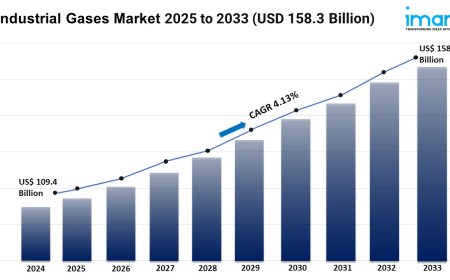

Global Molybdenum Market Growth, Share, and Forecast 2025-2033

The global molybdenum market size was valued at 5,868.7 Tons in 2024. Looking forward, IMARC Group estimates the market to reach 7,170.2 Tons by 2033, exhibiting a CAGR of 2.25% from 2025-2033.

Market Overview:

The molybdenum market is experiencing rapid growth, driven by surging demand from steel production, rising use in renewable energy technologies, and growth in aerospace and defense applications. According to IMARC Group's latest research publication, "Molybdenum Market Size, Share, Trends and Forecast by Product Type, Sales Channel, End Use, and Region, 2025-2033, the global molybdenum market size was valuedat5,868.7 Tonsin 2024. Looking forward, IMARC Group estimates the market to reach7,170.2 Tonsby 2033, exhibiting aCAGR of 2.25%from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report:https://www.imarcgroup.com/molybdenum-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Molybdenum Market

- Surging Demand from Steel Production

Molybdenums role as a key alloying agent in steel production is a major driver of its global demand. It enhances steels strength, corrosion resistance, and durability, making it essential for construction, automotive, and infrastructure projects. Approximately 80% of molybdenum is used in steel, with API-grade pipelines and LNG tankers being significant consumers. For instance, Chinas steel industry, a global leader, consumed 278.5 million pounds of molybdenum recently, reflecting robust demand. Government initiatives, like Chinas infrastructure stimulus plans, further boost steel production, increasing molybdenum needs. Companies like China Molybdenum Co. are ramping up output to meet this demand, with new projects in Henan province. This surge underscores molybdenums critical role in supporting global construction and industrial growth.

- Rising Use in Renewable Energy Technologies

Molybdenums application in renewable energy systems is fueling industry growth. Its vital for components in solar panels, wind turbines, and hydrogen production systems due to its high melting point and corrosion resistance. For example, molybdenum-based catalysts are used in green hydrogen production, aligning with global clean energy goals. Government schemes, such as the EUs Green Deal, promote renewable energy adoption, indirectly boosting molybdenum demand. In the U.S., companies like Freeport-McMoRan are increasing molybdenum production to supply renewable energy projects, with output reaching 33,000 metric tons recently. As nations push for net-zero emissions, molybdenums role in energy transition technologies continues to grow, making it a cornerstone of sustainable infrastructure development worldwide.

- Growth in Aerospace and Defense Applications

The aerospace and defense sectors are driving molybdenum demand due to its use in high-performance alloys for aircraft, missiles, and armor plating. Molybdenums heat resistance and strength are critical for these applications, with aerospace alone requiring 15% more molybdenum-intensive alloys annually. Government defense budgets, like the U.S.s $816 billion allocation, support this growth by funding advanced military equipment. Companies like BHP are expanding molybdenum mining operations in Chile to meet this demand, producing 38,000 metric tons recently. Additionally, aerospace giants like Boeing are incorporating molybdenum alloys in next-generation aircraft for better fuel efficiency. This trend highlights molybdenums strategic importance in high-stakes industries, ensuring steady market growth.

Key Trends in the Molybdenum Market

- Increased Focus on Recycling Molybdenum

Recycling molybdenum is gaining traction as industries prioritize sustainability. Molybdenum is 100% recyclable, and companies are investing in scrap segregation to maintain alloy purity. For example, a recent case study showed a 42% reduction in thermal distortion in EUV lithography machines by using recycled molybdenum rods, extending equipment lifespan by 18 months. Initiatives like the Initiative for Responsible Mining Assurance are pushing miners to adopt closed-loop systems, reducing waste. In the U.S., firms like Climax Molybdenum are scaling up recycling programs, processing thousands of tons of scrap annually. This trend aligns with global environmental goals and reduces reliance on primary mining, making the market more resilient and eco-friendly.

- Expanding Use in Semiconductor Manufacturing

Molybdenums role in semiconductor manufacturing is growing, driven by the booming demand for AI, 5G, and electric vehicles. Sintered molybdenum rods, with a melting point of 2,623C and high thermal conductivity, are replacing tungsten in chip-making equipment like EUV lithography machines. The semiconductor industry is projected to grow significantly, with molybdenum demand rising in tandem. Companies like Plansee Group are supplying high-purity molybdenum components to chip manufacturers, with production facilities expanding in Asia. For instance, China, producing 65% of global molybdenum, is increasing output to meet semiconductor needs. This trend reflects molybdenums critical role in enabling cutting-edge technology, ensuring its market relevance.

- Adoption in Medical and Diagnostic Applications

Molybdenum-99 (Mo-99) and Technetium-99m (Tc-99m) are seeing increased use in medical imaging and diagnostics, driving market growth. The Mo-99/Tc-99m market is valued at $450 million, with demand rising for diagnostic procedures like SPECT scans. Companies like GE Healthcare and Siemens Healthineers are investing in Mo-99 production facilities to meet this need. Government support, such as U.S. funding for domestic Mo-99 production, reduces reliance on imports and boosts supply stability. This trend is fueled by aging populations and growing healthcare needs, particularly in Asia-Pacific, where medical infrastructure is expanding. Molybdenums role in healthcare underscores its versatility and opens new market opportunities.

Leading Companies Operating in the Global Molybdenum Industry:

- ABSCO Limited

- American CuMo Mining Corporation

- Centerra Gold Inc.

- China Molybdenum Co. Ltd.

- China Rare Metal Material Co. Ltd.

- Codelco

- Freeport-McMoRan Inc.

- Grupo Mxico

- Jinduicheng Molybdenum Co. Ltd

- KGHM Polska Miedz S.A.

- Molten Corporation

- Moly Metal L.L.P

Molybdenum Market Report Segmentation:

By Product Type:

- Steel

- Chemical

- Foundry

- Molybdenum Metal

- Nickel Alloy

Based on the product type, steel dominates as the largest segment in product type due to the extensive use of molybdenum in steel alloys, which enhances their strength and corrosion resistance, meeting the diverse demands of industries such as construction, automotive, and infrastructure development.

By Sales Channel:

- Manufacturer/Distributor

- Aftermarket

Based on the sales channel, the market is classified into manufacturer/distributor and aftermarket.

By End Use:

- Oil and Gas

- Automotive

- Heavy Machinery

- Energy

- Aerospace and Defense

- Others

Based on the end use, the market is divided into oil and gas, automotive, heavy machinery, energy, aerospace and defense, and others.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Based on the region, Asia Pacific holds the largest market share due to its rapid industrialization, significant growth in construction, automotive, and aerospace sectors, and the presence of emerging economies that have increasing demands for high-strength steel and other molybdenum-based products.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the worlds most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

![Top 9 Real Estate Mobile App Developers in Riyadh, Saudi Arabia [2025 Edition]](https://www.biphoo.uk/uploads/images/202507/image_430x256_6879d0d524335.jpg)