Computer Vision Market Size, Share, Growth & Forecast 2025-2033

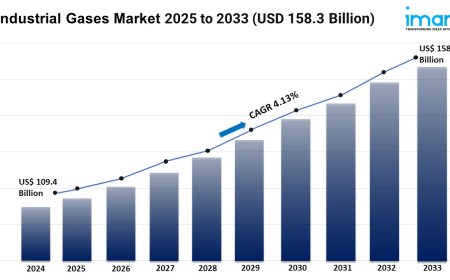

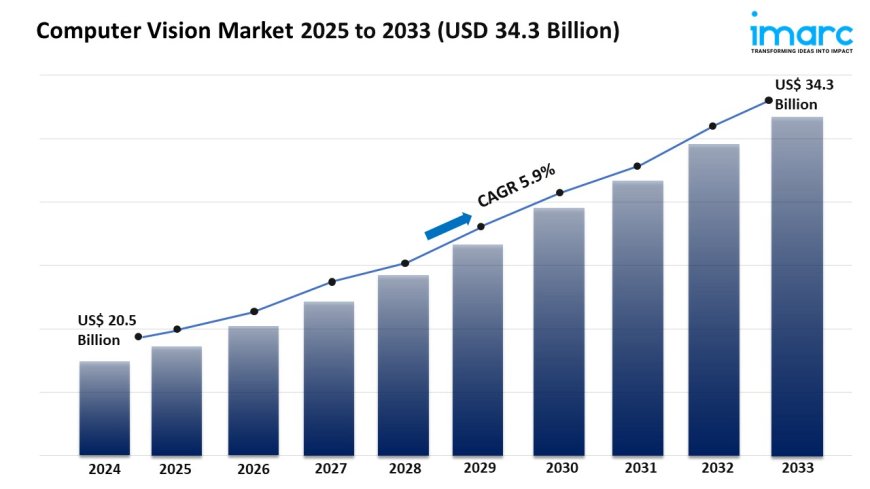

The global computer vision market size was valued at USD 20.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 34.3 Billion by 2033, exhibiting a CAGR of 5.9% during 2025-2033.

Market Overview:

The computer vision market is experiencing rapid growth, driven by rising demand for automation across industries, advancements in AI and machine learning, and surge in IoT and edge computing integration. According to IMARC Group's latest research publication, "Computer Vision Market Size, Share, Trends and Forecast by Component, Product Type, Application, Vertical, and Region, 2025-2033", the global computer vision market size was valuedatUSD 20.5 Billionin 2024. Looking forward, IMARC Group estimates the market to reachUSD 34.3 Billion by 2033, exhibiting a CAGR of5.9% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/computer-vision-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Computer Vision Market

- Rising Demand for Automation Across Industries

Businesses are racing to automate tasks to save time, cut costs, and boost accuracy, fueling the computer vision industrys growth. In manufacturing, companies like Siemens use computer vision to inspect products, spotting defects like scratches or misalignments in seconds, reducing errors by up to 28% compared to human checks. Retail giants like Amazon deploy vision systems for automated checkouts, with their Just Walk Out technology processing transactions in real time, slashing labor costs. The automotive sector relies on vision for advanced driver-assistance systems (ADAS), with over 50% of new vehicles now equipped with vision-based features like lane detection. Government initiatives, such as Chinas Made in China 2025 plan, push automation in manufacturing, amplifying demand for vision solutions to streamline workflows and ensure quality.

- Advancements in AI and Machine Learning

Breakthroughs in AI and machine learning are supercharging computer vision, making systems smarter and more accurate. Companies like NVIDIA are leading the charge with AI chips like the Jetson Orin, which processes up to 275 trillion operations per second, enabling real-time image analysis for applications like autonomous drones. Googles DeepMind has improved object detection algorithms, achieving over 90% accuracy in complex tasks like facial recognition. These advancements allow industries like healthcare to analyze medical images faster, with firms like Qure AI detecting abnormalities in X-rays with 95% precision. Government funding, such as the U.S. National AI Research Institutes investing millions in AI innovation, supports these leaps, driving adoption across sectors by making computer vision more reliable and accessible.

- Surge in IoT and Edge Computing Integration

The explosion of IoT devices and edge computing is pushing computer vision to new heights. With over 15 billion IoT devices globally, vision systems process data locally for faster decisions, like smart cameras in retail tracking inventory in real time. Intels Gaudi 3 AI accelerator, launched recently, boosts edge-based vision processing, cutting latency by 30% for applications like smart city surveillance. Telecom giants like AT&T leverage 5G to integrate vision with IoT, enabling real-time traffic monitoring in cities like Dubai. Government schemes, such as the UAEs smart city projects, invest heavily in IoT-driven vision for traffic and security systems, creating a robust ecosystem where computer vision thrives by handling massive visual data streams efficiently.

Key Trends in the Computer Vision Market

- Real-Time Video Analytics for Security and Surveillance

Real-time video analytics is transforming security, with computer vision enabling instant threat detection. Systems like Hikvisions AI-powered cameras analyze crowds for anomalies, reducing response times by 40% in public spaces like airports. In retail, Walmart uses vision to monitor shelves, cutting stockout incidents by 25%. Governments are jumping inChinas smart city initiatives deploy facial recognition across 600 million cameras, enhancing public safety. These systems use advanced algorithms to spot behaviors like shoplifting or overcrowding in real time, making them critical for urban management. As video data surgesgenerating over 80% of global internet trafficbusinesses and cities are investing in scalable vision solutions to ensure safety and efficiency without human oversight.

- Generative AI for Synthetic Data Creation

Generative AI is shaking up computer vision by creating synthetic data to train models faster and cheaper. Companies like Meta use generative tools to produce realistic images for facial recognition training, cutting data collection costs by up to 50%. This trend tackles privacy concerns, as synthetic data avoids using real personal images. In healthcare, firms like GE Healthcare generate synthetic X-rays to train diagnostic models, improving detection accuracy by 20%. The technology also speeds up labelingOpenAIs tools auto-label datasets 10 times faster than manual methods. As businesses face stricter data privacy laws, like the EUs GDPR, generative AI offers a game-changing way to build robust computer vision systems without compromising ethics or budgets.

- Growth of Vision-Guided Robotics

Vision-guided robotics is booming, especially in manufacturing and logistics. Companies like Fanuc integrate 3D vision cameras into robots, boosting pick-and-place accuracy by 30% in warehouses. Amazons robotic arms, powered by vision systems, handle over 700 million packages annually, reducing human error by 26%. In agriculture, John Deeres AI-driven tractors use vision to monitor crops, improving yield predictions by 15%. Japans Ministry of Economy, Trade and Industry supports this trend with funding for AI robotics, driving adoption in factories. As industries push for precision and speed, vision-guided robots are becoming essential, blending advanced imaging with AI to tackle complex tasks like assembly and quality control with unmatched efficiency.

Leading Companies Operating in the Global Computer Vision Industry:

- Basler AG

- Baumer Optronic

- CEVA Inc.

- Cognex Corporation

- Intel Corporation

- Jai A/S

- Keyence Corporation

- Matterport Inc.

- Microsoft Corporation

- National Instruments

- Sony Corporation

- Teledyne Technologies Inc.

Computer Vision Market Report Segmentation:

By Component:

- Hardware

- Software

Hardware represents the largest segment as it encompasses essential components, such as cameras, processors, sensors, and memory, which are fundamental for implementing computer vision systems.

By Product Type:

- Smart Camera-based

- PC-based

PC-based accounts for the majority of the market share due to its reliance on computational power and flexibility of personal computers, making them widely adopted for various computer vision applications.

By Application:

- Quality Assurance and Inspection

- Positioning and Guidance

- Measurement

- Identification

- Predictive Maintenance

- 3D Visualization and Interactive 3D Modelling

Quality assurance and inspection lead the market with a 17.3% share in 2024, as industries adopt AI-driven vision systems to enhance defect detection and operational efficiency while reducing human error and production costs.

By Vertical:

- Industrial

- Non-Industrial

The industrial sector dominates in 2024, fueled by automation and AI advancements, as manufacturers integrate computer vision for defect detection and process optimization, enhancing efficiency and reducing costs in sectors like automotive and electronics.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific enjoys the leading position in the computer vision market on account of rapid industrialization, technological advancements, and high adoption rates of automation across various industries.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the worlds most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

![Top 9 Real Estate Mobile App Developers in Riyadh, Saudi Arabia [2025 Edition]](https://www.biphoo.uk/uploads/images/202507/image_430x256_6879d0d524335.jpg)