Residential Washing Machine Market Outlook, Growth Opportunities, and Forecast 2025-2033

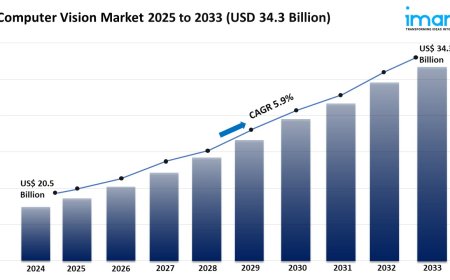

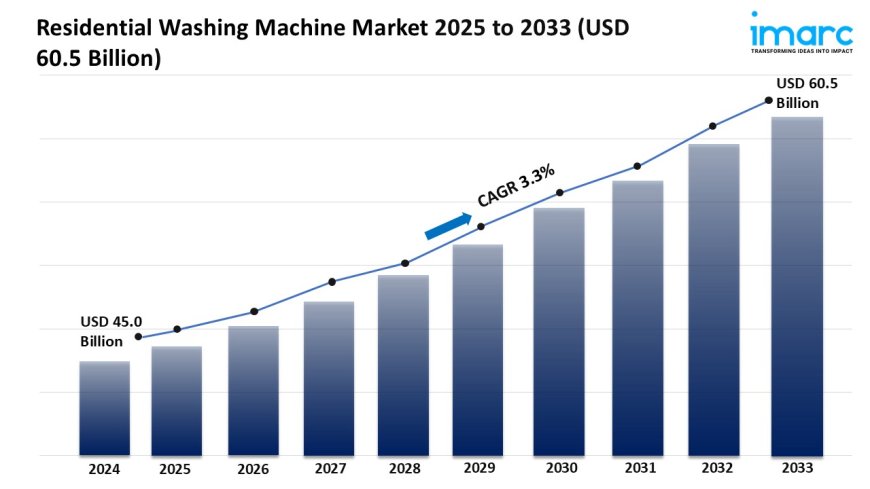

The global residential washing machine market size was valued at USD 45.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 60.5 Billion by 2033, exhibiting a CAGR of 3.3% from 2025-2033.

Market Overview:

The residential washing machine market is experiencing rapid growth, driven by rising demand for energy-efficient appliances, urbanization and smaller living spaces, and technological advancements in smart features. According to IMARC Group's latest research publication, "Residential Washing Machine Market Size, Share, Trends and Forecast by Product, Technology, Machine Capacity, Distribution Channel, and Region, 2025-2033, the global residential washing machine market size was valuedatUSD 45.0 Billionin 2024. Looking forward, IMARC Group estimates the market to reachUSD 60.5 Billionby 2033, exhibiting aCAGR of 3.3%from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/residential-washing-machine-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Residential Washing Machine Market

- Rising Demand for Energy-Efficient Appliances

As residential consumerism continues to focus on sustainability, homeowners also demand energy-efficient washing machines. These demands have helped fuel the development of energy-efficient appliances, which draw less electricity and water, while also meeting global climate targets and higher consumer education on sustainability issues. Brands like Bosch and LG have introduced new technology into their washing machines with advanced inverter motors and eco-wash cycles to appeal to eco-conscious purchasing behavior in end users. Consumer action is also spurred by government incentives, such as tax rebates on energy-saving appliances in places like the United States and India. Sustainability purchasing trends "are especially increasing in urban areas, where expensive utility rates are making homeowners look for greener options with lower costs to manage their bills," fostering the growth of the washing machine market.

- Urbanization and Smaller Living Spaces

Rapid urbanization, especially in developing economies, has led to a growing demand for compact and space-efficient washing machines. As people move to cities and live in apartments, appliance manufacturers are creating extremely slim, stackable or portable-style models for smaller households. Haiers compact front-load washers have experienced growth in densely populated regions like Asia-Pacific, which are popular among somewhat younger (young professionals) and small families in a rush (for either convenience sake, or they feel like they are living with limited space but do NOT want to compromise on washing performance). The nuclear family model and increasing single-person households are also encouraging the need for washing machines, for action taking place now during the pandemic, etc., for this simple reason of space.

- Technological Advancements in Smart Features

The integration of smart technology into washing machines is a major growth driver. Features like Wi-Fi connectivity, app-based controls, and AI-driven wash cycles enhance user convenience and efficiency. Samsungs SmartThings-enabled washers, for instance, allow users to monitor and control their laundry remotely, appealing to tech-savvy consumers. These innovations also enable predictive maintenance, reducing downtime and repair costs. As smart home ecosystems gain traction, demand for interconnected appliances rises, particularly among millennials and Gen Z. This technological evolution not only improves user experience but also encourages manufacturers to innovate, expanding the market.

Key Trends in the Residential Washing Machine Market

- Growing Popularity of Front-Load Washing Machines

Front-load washing machines are becoming more popular because they clean better, save better water, and are gentler on clothes than top load machines. Top load machines may still be more common among consumers, however, front-loading models appeal to consumers because they do not take as much of a beating on clothes. Brand names like Whirlpool are seeing strong sales of front-load models in Europe and North America, as consumers are enjoying the fact that front-load models tend to use less energy. We are also seeing this trend toward front-load machines in emerging markets like India. With rising disposable incomes, consumers are more willing to purchase premium appliances and are showing a preference for efficiency, quality, and usability.

- Increased Focus on Hygiene Features

Consumer behavior following the pandemic has been a signifier of the importance of hygiene and cleanliness, resulting in demand for washing machines that perform sanitization. Inexpensive, mid-range, and premium models routinely feature steam mode cycles, UV lights, and antibacterial drum coatings. An example of this is LG, whose steam-enabled washers eliminated allergens and bacteria from laundry and requests from families with young children or individuals who were allergic remained steady. Manufacturers are actively promoting additional washing machine technologies to appeal to health- and hygiene-conscious consumers, especially in regions like South Asia where pollution levels can be high. This example demonstrates a larger movement that points to a transformative shift to health and safety-first appliances, which has substantially impacted consumers' purchasing approaches.

- Expansion of E-Commerce and Direct-to-Consumer Sales

The rise of e-commerce has transformed the washing machine market, offering consumers greater access to a wide range of products and competitive pricing. Online platforms like Amazon and Flipkart provide detailed product comparisons, customer reviews, and discounts, making it easier for buyers to choose. Brands like Miele have also adopted direct-to-consumer (D2C) models, selling premium washers through their websites to build stronger customer relationships. This trend has accelerated in rural and semi-urban areas, where online penetration is growing, enabling manufacturers to reach untapped markets and driving overall sales growth.

Our comprehensive residential washing machine market outlook reflects both short-term tactical and long-term strategic planning. This analysis is essential for stakeholders aiming to navigate the complexities of the residential washing machine market and capitalize on emerging opportunities.

Leading Companies Operating in the Residential Washing Machine Industry:

- Electrolux AB

- Godrej Consumer Products Ltd.

- Haier Group Corporation

- Hitachi Ltd.

- IFB Industries Limited

- LG Electronics Inc.

- Midea Group

- Miele

- Panasonic Holdings Corporation

- Robert Bosch GmbH

- Samsung Electronics Co. Ltd.

- Toshiba Corporation

- Whirlpool Corporation

Residential Washing Machine Market Report Segmentation:

By Product:

- Fully Automatic

- Semiautomatic

- Dryer

Fully automatic washing machines dominate the market with around 61.0% share in 2024, offering time efficiency and ease of use through automation and smart technology.

By Technology:

- Top Load

- Front Load

Top load washing machines lead with approximately 54.15% market share in 2024, favored for their familiarity, accessibility, and ongoing innovations that enhance user experience.

By Machine Capacity:

- Below 6 Kg

- 6 to 8 Kg

- 8 Kg and Above

The 6 to 8 kg capacity range holds the largest market share at around 47.6% in 2024, ideal for medium-sized households and balancing efficiency with versatility for various laundry needs.

By Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Department Stores

- E-Commerce

- Others

Specialty stores lead distribution channels with about 25.6% market share in 2024, providing expert recommendations and a comprehensive range of washing machines for informed purchasing decisions.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific accounts for over 33.5% of the market share in 2024, driven by rising disposable incomes, cultural emphasis on cleanliness, and the presence of manufacturing hubs facilitating accessibility.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the worlds most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

![Top 9 Real Estate Mobile App Developers in Riyadh, Saudi Arabia [2025 Edition]](https://www.biphoo.uk/uploads/images/202507/image_430x256_6879d0d524335.jpg)