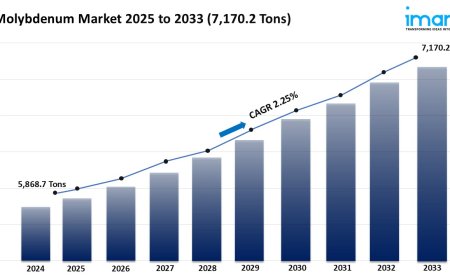

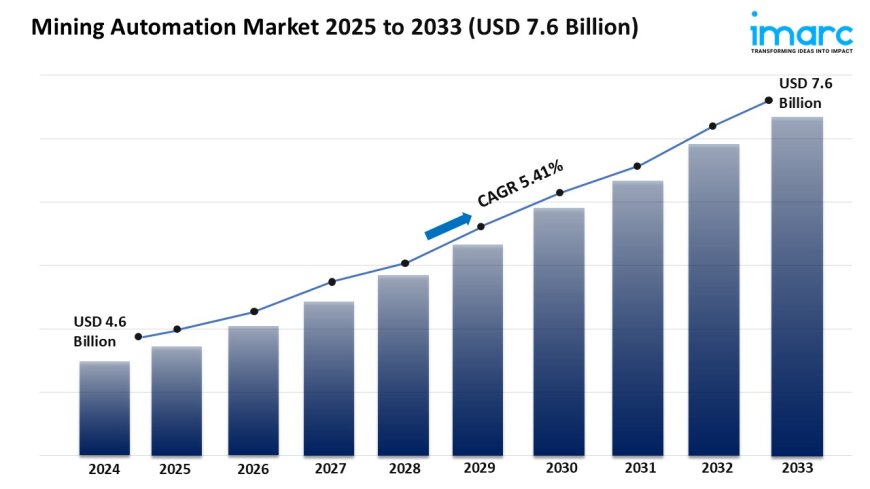

Mining Automation Market Growth, Share, and Forecast 2025-2033

The global mining automation market size was valued at USD 4.6 Billion in 2024. Looking forward, the market is expected to reach USD 7.6 Billion by 2033, exhibiting a CAGR of 5.41% from 2025-2033.

Market Overview:

The mining automation market is experiencing rapid growth, driven by rising demand for operational efficiency, enhanced worker safety, and push for sustainable practices. According to IMARC Group's latest research publication, "Mining Automation Market Size, Share, Trends and Forecast by Solution, Technique, Application, and Region, 2025-2033", the global mining automation market size was valuedatUSD 4.6 Billionin 2024. Looking forward, the market is expected to reachUSD 7.6 Billionby 2033, exhibiting aCAGR of 5.41%from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/mining-automation-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Mining Automation Market

- Rising Demand for Operational Efficiency

Mining isnt easy. Its a rugged industry, full of difficult challenges, low margins, and constant demands. Automation is altering this paradigm by delivering productivity gains that people and old-school machines simply cant match in terms of efficiency. Imagine a mine in Australias Pilbara region: autonomous haul trucks operating 24-hours a daysignificantly reducing fuel and cycle time. Autonomous haul trucks dont require coffee breaks or shift changes, so productivity can flourish. Autonomous haul trucks are also accurate in terms of productivity. The truck routes are optimized based on sensors and artificial intelligence that takes into account ground condition and equipment wear and tear. Companies such as Rio Tinto have fully incorporated autonomous haulage into their operations by introducing AutoHaul trains to quickly move iron ore. It is not just about speed; its about extracting the maximum value from business operations whilst containing business overheads.

- Enhanced Worker Safety

No one wants to put workers in dangerous locationsdeep underground or near a loose rock face is about as dangerous as it gets. Because of automation, we need fewer people in dangerous areas. Remote controlled drill rigs and robotic inspection systems mean fewer bodies in dangerous areas. When BHP used drones to inspect tailing dams, it transferred the risk away from someone climbing a loose slope or standing under an unstable rock face. And those data, from robots like drones, may even contribute to predicting hazardous events before they spiral into disaster. This is not to say robots, or automation, are perfect; they can and do fail. But the pattern is undeniably evident: mining is becoming safer due to more automation. This is a great thing when you think about the human impact to accidents, and the strong push on the industry to clean up its safety record.

- Push for Sustainable Practices

Mines have a reputation for being bad for the environment, deservedly so due to the scars on the land, as well as their carbon footprint, but automation is helping to change that. The vehicle of the future, such as the electric autonomous vehicles tested by Sandvik, limits emissions compared to traditional diesel trucks, which are quite literally gas guzzlers in comparison. Automation and AI have also contributed to better practices by optimizing resource extraction, which in turn minimizes waste. For example, Newmont operates fully automated processing plants that optimize specific ore processing using real-time data to minimize water and other inputs and forecasts energy inputs in real time before they are used. This isn't greenwashing; these are now being demanded by regulators and communities alike, and automated technologies are providing real and measurable returns. Moreover, mines that dont embrace sustainable practices are signaling a blaring red light - a bad image. Sustainable technologies save operating costs, and potentially, avoid cost over-runs in the future.

Key Trends in the Mining Automation Market

- Adoption of AI and Machine Learning

AI isn't exclusive to tech bros, it's part of the future of mining. Machine learning has the capacity to process huge datasets and analyze the data for indications of likely equipment failures or if operations are optimizing the ore grade. Consider a hypothetical gold mine located in Nevada, where AI is able to analyze rock samples and find patterns, in order to guide drill holes into the better ore deposits. In 2018, Goldcorp was able to use IBM's Watson AI program to organize their empirical data on exploration and enhance the accuracy of future exploration, saving them millions of dollars compared to exploring without evidence. Of course, it's not all sunshine and rainbows; AI operates best with clean data, complex algorithms, and multidisciplinary teams that know what they want to solve, but when it works, it is like dealing with a brilliant geologist who never sleeps. When it comes to this trend, adoption rates are increasing fast as mines search for more intelligent ways to compete in a rapidly evolving market.

- Integration of IoT and Real-Time Data

Mines are wired like never before using the Internet of Things (IoT). Everything is wired up: trucks, conveyors, even workers helmets have sensors on them sending real time data back to their control centers. In Glencore's Matagami and other IoT-connected mines, sensors monitor equipment healthand trigger if necessaryso problems are identified before they stop production. Imagine a mine with a nervous system, where every body part talks to every other body part. The promise of the IoT is realised in not just reduced downtime, but boosted production rates. However, real-time data updates are valuable not just for machines; the IoT is useful for managers too, providing options when a truck cant be usedlike routing the trucks elsewhere during a snow storm! It's important to consider the drawbacks; cyber security is growing, as mines become scarier thoughts, and IoT-growing in connectivity and sophistication, will have prospects to secure.

- Growth of Autonomous Fleets

Autonomous vehicles aren't a thing of the future; they are transporting ore in mines around the planet. In the autonomous mining space, it is Caterpillar's driverless trucks and Komatsu's robotic loaders that are being deployed in fleets to haul ore away. At the Fortescue iron ore mines, the use of autonomous trucks has been a game changer providing lower operating costs with greater output. And, it isn't simply that these trucks are robots, they are autonomous and are networked so they can communicate with each other to eliminate the possibility of collisions while optimizing their hauling routes. It is similar to watching a swarm of ants scurry about in unison. The pace of change is accelerating, and since many of the associated costs are declining, more mines are embracing the new technology. There are always bumps in the road - such as getting stuck in remote areas with poor connectivity. Nevertheless, autonomous fleets are the future, and they are here to stay in the mining industry.

We explore the factors propelling the mining automation market growth, including technological advancements, consumer behaviors, and regulatory changes.

Leading Companies Operating in the Global Mining Automation Industry:

- AB Volvo

- ABB Ltd

- Autonomous Solutions Inc.

- Caterpillar Inc.

- Hexagon AB

- Hitachi Construction Machinery Co. Ltd. (Hitachi Ltd.)

- Komatsu Mining Corp. (Komatsu Ltd.)

- Micromine Pty Ltd. (Aspen Technology, Inc)

- Remote Control Technologies Pty Ltd (Epiroc AB)

- Rio Tinto Plc

- Rockwell Automation Inc.

- Sandvik AB

- Siemens AG

- Trimble Inc.

Mining Automation Market Report Segmentation:

By Solution:

- Software Automation

- Services

- Implementation and Maintenance

- Training

- Consulting

- Equipment Automation

- Autonomous Truck

- Remote Control Equipment

- Teleoperated Mining Equipment

Equipment automationlargest component in 2024, enhancing mining efficiency and safety by reducing human limitations and exposure to hazardous environments.

By Technique:

- Underground Mining Automation

- Surface Mining Automation

Underground mining automationleads the market with 34.5% share in 2024, improving safety and operational efficiency by removing workers from hazardous conditions and enabling remote control of mining activities.

By Application:

- Metal Mining

- Mineral Mining

- Coal Mining

Mineral miningdominates the market with 34.8% share in 2024, utilizing automation to enhance operational efficiency and safety in complex mining environments while meeting growing mineral demand.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia-Pacificholds the largest market share of 39.7% in 2024, driven by mining industry growth, abundant resources, and government support for automation technologies to improve productivity and safety.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the worlds most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

![Top 9 Real Estate Mobile App Developers in Riyadh, Saudi Arabia [2025 Edition]](https://www.biphoo.uk/uploads/images/202507/image_430x256_6879d0d524335.jpg)